Cannabidiol (CBD) products have sparked a lot of curiosity and discussion in India, especially in recent years.

India’s weight loss market is experiencing significant growth, driven by an increasing demand for scientifically-backed, natural solutions targeting appetite regulation, gut health, and metabolic disorders.

Wellness startups are leading this shift by offering innovative products that address the root causes of weight gain, focusing on sustainable and holistic approaches rather than quick fixes.

In 2025, this landscape is marked by a growing emphasis on gut health, metabolism-boosting supplements, and appetite-control products, all aiming to provide long-term solutions for weight management.

India’s wellness sector is booming, with startups shifting their focus from traditional methods like exercise plans and calorie-counting diets to addressing the physiological mechanisms behind weight gain.

Key areas such as gut health, appetite regulation, and metabolic disorders are becoming central to weight loss solutions, influencing how the body stores and burns fat.

The rising prevalence of obesity, diabetes, and PCOS (Polycystic Ovary Syndrome) has underscored the need for more innovative and sustainable approaches to weight management.

In this context, pharmaceutical weight loss solutions like Ozempic and Mounjaro, both GLP-1 receptor agonists, have sparked significant interest in the market.

These drugs regulate hormonal pathways to control appetite and boost metabolic function, offering a clinically proven method of weight loss.

However, this growing reliance on pharmaceutical solutions has also prompted wellness startups to explore natural alternatives that mimic the effects of GLP-1 through supplements designed to regulate gut health, improve insulin sensitivity, and help control appetite.

Wellness startups are increasingly developing products using probiotics, prebiotics, and fiber to support gut health, boost metabolism, and regulate appetite.

These natural, non-pharmaceutical solutions aim to offer long-term benefits without the side effects typically associated with prescription drugs, providing an attractive option for consumers seeking sustainable weight loss solutions that align with their preference for more holistic approaches.

The Indian weight management market is projected to reach $55.9 billion by 2033, growing at an 8.79% CAGR (Source: IMARC Group).

In 2024, the weight loss market was valued at $25.2 billion, with a significant portion driven by products targeting gut health and metabolic health.

Experts predict that the weight loss supplement market will grow by 23% annually, with products like GLP-1 activators and gut health supplements playing a major role in this expansion.

In particular, the market for weight loss drugs is valued at ₹576 crore as of March 2025, with rapid growth expected as the Indian market moves toward more affordable, generic GLP-1 drugs post-2026.

Alongside these pharmaceutical advancements, nutraceuticals focused on appetite control and metabolism-boosting solutions are becoming key components of the weight loss industry.

India is now the third-largest obesity market, trailing only the US and China, according to Shashwata Narain, co-founder of Veera Health.

This surge in obesity is largely driven by dietary patterns, urbanization, sedentary lifestyles, and a higher prevalence of diabetes and metabolic disorders.

In fact, India has one of the largest populations with metabolic diseases, which have been compounded by an increasing number of comorbidities related to obesity.

Obesity is now being recognized as a disease globally, with weight loss solutions being a rapidly growing industry.

While pharmaceuticals like Ozempic and Mounjaro (GLP-1 agonists) have revolutionized weight loss treatment, their affordability and accessibility remain a challenge for many.

As a result, there has been a surge in demand for alternative solutions—natural supplements designed to regulate gut health, improve insulin sensitivity, and manage appetite without the side effects often associated with pharmaceutical drugs.

This growing health crisis has given rise to numerous wellness startups in India, offering nutraceuticals and supplements as more affordable, accessible solutions for weight loss.

These products are gaining traction among urban populations, who are increasingly aware of the importance of preventative health.

India’s nutraceutical market is estimated to be worth $8 billion by 2024, with the market for vitamins, minerals, and supplements specifically for weight loss and a healthy lifestyle valued at $1.7 billion.

The functional food and beverage market, including protein drinks and probiotic beverages, makes up an additional $6.3 billion of this figure.

According to a 2024 Kearney report, the rise of these products reflects a strong demand for weight management solutions that are more affordable than pharmaceutical weight loss drugs like Mounjaro (₹17,500/month) or Ozempic.

Compared to these weight loss drugs, which have shown weight loss results ranging from 15% to 22.5% body weight reduction over 72 weeks, nutraceuticals offer a much cheaper alternative.

Supplements like those from The Good Bug or Veera Health cost around ₹2,000 a month, making them more accessible to a wider demographic.

These products, which target gut health and regulate GLP-1 production naturally, are growing in popularity as consumers look for cost-effective ways to manage their weight.

While GLP-1 drugs provide fast and dramatic results, they come with significant side effects such as nausea, vomiting, and gastrointestinal issues.

On the other hand, health supplements are perceived to offer gradual, sustainable weight loss without such side effects, making them an attractive option for those unable to afford or unwilling to use prescription drugs.

The growing recognition of the relationship between gut health and weight management has propelled wellness startups to create products that support gut microbiota balance.

Research suggests that a healthy gut microbiome can influence appetite regulation, metabolism, and fat storage.

Wellness startups like The Good Bug are developing supplements that aim to optimize gut health and regulate GLP-1 (a hormone that promotes satiety and controls appetite), indirectly helping consumers manage their weight more effectively.

Products that target appetite regulation are gaining popularity.

By focusing on hormones like ghrelin (the hunger hormone) and leptin (the satiety hormone), these supplements help reduce cravings and prevent overeating.

Startups such as Wellbeing Nutrition offer natural solutions designed to boost metabolism and curb hunger using ingredients like fiber, green tea extract, and chromium picolinate, providing a natural way to control appetite and support weight loss.

Metabolic disorders, such as insulin resistance and slow metabolism, are significant contributors to weight gain and obesity.

Startups are developing products to improve insulin sensitivity, boost metabolism, and support fat-burning processes.

For instance, Veera Health offers a supplement designed to target metabolic issues related to PCOS, helping to regulate insulin levels and reduce abdominal fat.

In response to the rising demand for GLP-1-based weight loss solutions, wellness startups are exploring natural alternatives that stimulate GLP-1 production.

These products focus on improving appetite regulation and weight loss by enhancing GLP-1 secretion from the gut.

Companies like The Good Bug and Wellbeing Nutrition are pioneering efforts to create natural supplements that trigger GLP-1, providing a holistic alternative to pharmaceutical solutions like Ozempic and Mounjaro.

Many wellness startups are shifting towards personalized weight loss plans that take into account individual medical conditions, gut health, and metabolism.

Rather than offering quick fixes, these platforms focus on long-term habit changes, using technology and professional guidance to create tailored solutions.

Startups like Fitelo offer AI-driven, personalized weight loss plans that help users optimize their metabolism and regulate appetite through sustainable habit formation.

Several innovative startups are leading the way in addressing appetite regulation, gut health, and metabolic health for weight loss:

Several key factors are contributing to the rise of wellness startups in India’s weight loss market. These include increased focus on gut health, the rise of lifestyle diseases, technological innovations, and government support.

The gut microbiome is increasingly recognized for its role in regulating appetite, metabolism, and fat storage.

Startups are developing solutions like probiotics, prebiotics, and fiber supplements to promote gut health, which in turn supports appetite regulation and sustainable weight management.

India is facing a significant rise in lifestyle diseases such as obesity, type 2 diabetes, and PCOS.

These conditions, often associated with metabolic disorders, have driven demand for targeted weight loss solutions.

Startups like Veera Health are addressing these issues by offering supplements that balance insulin levels and support fat loss.

Technology-driven health solutions, including AI platforms, wearables, and mobile apps, are transforming the weight loss market.

Startups like HealthifyMe and Fitelo are leveraging data to offer personalized weight loss plans, helping users track progress, optimize their metabolism, and make real-time adjustments to their routines.

The Indian government has introduced various schemes to support the growth of wellness startups. These include:

In urban India, the demand for weight loss wellness products has surged significantly.

Consumers are increasingly seeking effective, non-pharmaceutical solutions to manage their weight, which has resulted in a booming market for dietary supplements, probiotics, prebiotics, and fiber-based products.

According to reports, the weight loss supplements market in India is projected to reach $3.83 billion by 2030, growing at a CAGR of 19.7%

This surge in demand is driven by factors like urbanization, increasing health awareness, and the prevalence of obesity and related lifestyle diseases.

Urban cities such as Bengaluru and Delhi are seeing a higher uptake of wellness products, with startups capitalizing on this trend by offering products that support gut health, hormonal regulation, and metabolic balance.

Startups are responding with natural supplements that help regulate appetite and improve digestion, offering consumers a sustainable approach to weight loss without the side effects often associated with prescription drugs.

The weight loss wellness market continues to grow as more people seek holistic, long-term solutions to manage their weight.

Despite the significant growth in the wellness sector, startups face several challenges, including market competition, regulatory hurdles, scientific validation, and building consumer trust.

The weight loss market in India is highly competitive, with many players offering similar products.

Startups must differentiate themselves by offering unique formulations, personalized solutions, and innovative technology to capture attention and stand out in the crowded market.

Navigating the complex regulations set by bodies like FSSAI can be challenging, especially for new startups.

These regulations cover ingredient approval, product labeling, and health claims, making it essential for startups to adhere to strict guidelines while maintaining marketing effectiveness.

To compete with pharmaceutical solutions, wellness startups must invest in clinical trials and peer-reviewed studies to prove the efficacy of their products.

This process can be expensive and time-consuming, particularly for smaller companies with limited budgets.

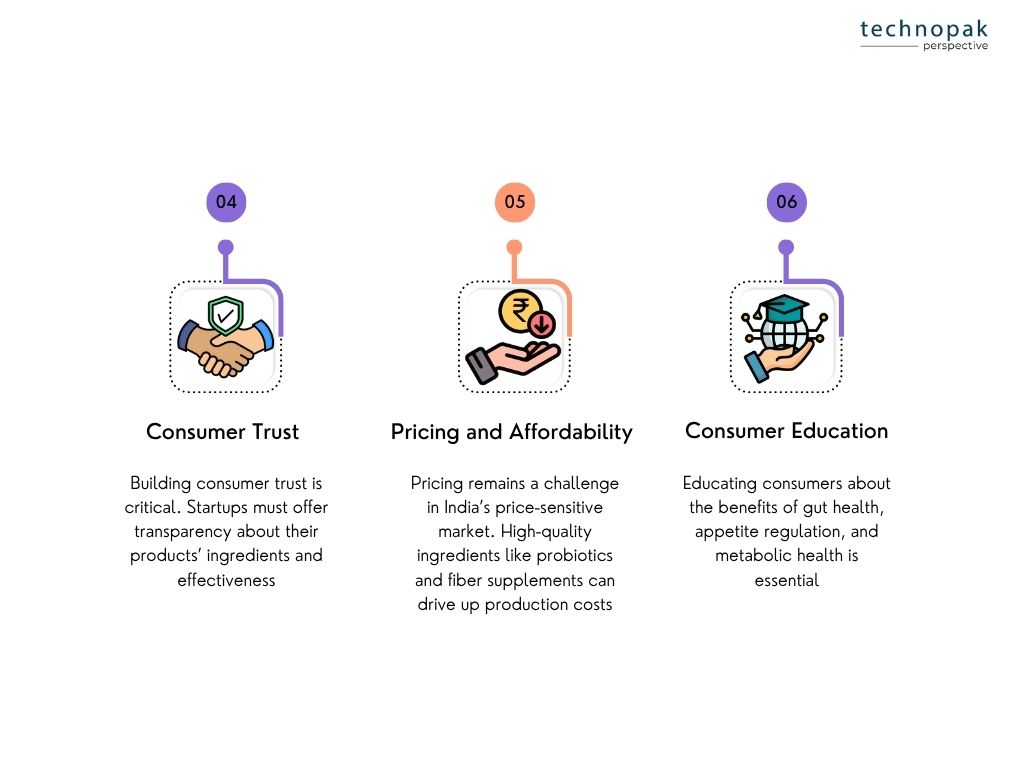

Building consumer trust is critical. Startups must offer transparency about their products’ ingredients and effectiveness.

Positive social proof, such as reviews and testimonials, is essential for building credibility and consumer confidence.

Pricing remains a challenge in India’s price-sensitive market. High-quality ingredients like probiotics and fiber supplements can drive up production costs.

Startups need to balance product quality with affordability to meet consumer expectations.

Educating consumers about the benefits of gut health, appetite regulation, and metabolic health is essential. Many consumers are still unfamiliar with how these factors influence weight loss, and startups must invest in clear, relatable marketing to bridge this knowledge gap.

The future of wellness startups in India’s weight loss segment is poised for significant transformation, driven by emerging trends in technology, sustainability, and personalized health.

While personalized weight loss solutions, AI, and wearables will continue to drive growth, we expect these technologies to evolve into even more sophisticated and integrated systems.

Here are the key trends shaping the future outlook:

1. Advanced AI Integration for Predictive Weight Management

As AI technology evolves, wellness startups will not only offer personalized plans but will also embrace predictive analytics for weight management.

For instance, startups like HealthifyMe and Fittr are already using AI to provide customized weight loss solutions, tracking data from wearables like Fitbit and Apple Watch.

In the future, these platforms will go a step further, utilizing advanced algorithms to predict potential weight gain based on factors like sleep patterns, stress levels, and metabolic rate.

AI-powered systems will be able to offer early interventions, such as recommending changes in diet or exercise before weight gain becomes a significant issue.

Startups such as InstaWeight, which focuses on insulin resistance and metabolic health, could use AI to better personalize weight loss strategies and help individuals manage their weight long-term by preventing metabolic disturbances before they manifest.

2. Biohacking and Personalized Wellness Solutions

The future will see a rise in biohacking and personalized wellness as the next frontier in weight loss.

Companies like TrueBasics and NutraBlast are already pushing boundaries with products like prebiotic and probiotic supplements that improve gut health, which directly influences weight management.

Startups will offer even more genetic-based weight loss solutions, where customers can send in their DNA samples and receive a tailored nutrition and fitness plan.

This is similar to what DNAfit offers internationally, but with a local twist—considering Indian diets and lifestyle.

Indian startups could partner with genetic labs to offer personalized reports based on genetic predispositions to weight gain, metabolism, and fat storage, allowing individuals to optimize their weight loss based on their unique genetic makeup.

3. Integration of Wellness and Healthcare

The integration of wellness startups and healthcare providers will become increasingly important.

As the market matures, we can expect partnerships between wellness companies and medical institutions to offer integrated solutions that blend medical treatment with lifestyle modifications.

For example, HealthifyMe could collaborate with clinics or hospitals to offer more holistic care, combining medical consultations with personalized diet plans and fitness routines.

Ayushman Bharat may serve as a platform for startups like RiteBite to promote holistic, preventive health solutions alongside the traditional healthcare infrastructure, blending technology and medical knowledge to improve overall wellness.

4. Sustainability as a Core Value

As consumers demand more eco-friendly options, wellness startups will need to prioritize sustainability in both products and practices.

Startups like Wellbeing Nutrition and GreenFibre Nutrition are already leading the charge by offering plant-based protein supplements and using biodegradable packaging.

In the future, we can expect even more innovation in sustainable sourcing, with brands like Curefit and The Good Bug promoting zero-waste wellness products and regenerative agriculture practices.

Wellness brands will also focus on reducing their carbon footprint through eco-friendly production methods and ethical sourcing of ingredients.

For instance, GreenFibre Nutrition could expand their line of plant-based protein powders, incorporating sustainably farmed ingredients like hemp and chia seeds.

5. Regulation and Consumer Trust

As the wellness sector grows, startups will need to adapt to increasing regulatory scrutiny around supplements, health claims, and data privacy.

Companies like Fitelo and HealthifyMe that provide AI-powered weight loss solutions will need to ensure they comply with Indian regulations on data privacy and consumer protection, similar to the GDPR standards in the EU.

Future startups might partner with regulatory bodies like the Food Safety and Standards Authority of India (FSSAI) to ensure transparency in the ingredients used in supplements.

Wellbeing Nutrition already champions transparency by listing all ingredients and their sources, but as the industry matures, more startups will follow suit to gain consumer trust by providing third-party lab testing results and clear labeling.

6. Rising Demand for Functional Foods and Supplements

The demand for functional foods and natural supplements will continue to rise, with startups innovating in areas like gut health, appetite regulation, and metabolic balance.

Startups like The Belly Lab and NutraBlast are already creating fiber-rich and prebiotic supplements that not only support gut health but also help regulate appetite.

Moving forward, we can expect to see products targeting specific metabolic conditions, such as insulin resistance, thyroid disorders, and hormonal imbalances.

MetabX, which offers supplements focused on boosting fat burning and insulin sensitivity, is an example of a startup likely to capitalize on this demand, developing more targeted, evidence-backed products.

Wellness startups in India are leading the way in transforming weight loss solutions in 2025.

By focusing on appetite regulation, gut health, and metabolic health, these companies are offering innovative, science-backed solutions that cater to the growing demand for natural, sustainable weight loss products.

As the market grows, startups must navigate challenges like competition, regulations, and consumer trust, but those that focus on scientific credibility, personalized solutions, and sustainability will lead the way in the coming years.

Technopak can help your wellness and holistic healthcare brand scale.

With over 33 years of experience, Technopak has helped more than 500 companies like yours, including industry leaders, go from ₹10 million to ₹200 million in annual turnover.

We turn decisions into actions with tailored end-to-end solutions, backed by our 80+ skilled consultants and expertise in consulting, skilling, and marketing partnerships across 17+ nations.

Ready to take your wellness brand to the next level? Get in touch today and let Technopak’s expertise help scale your brand with tailored solutions

The Indian weight loss market in 2025 is heavily focused on sustainable weight management solutions that emphasize gut health, metabolism-boosting supplements, and appetite regulation. As consumers move away from quick fixes, wellness startups are innovating with science-backed products that target the root causes of weight gain, offering more holistic, long-term solutions for weight loss.

Wellness startups in India are shifting from traditional methods like calorie-counting diets and exercise plans to more holistic and innovative approaches. These startups focus on gut health, metabolic disorders, and appetite control, creating products like probiotics, prebiotics, and fiber-based supplements to address the physiological factors behind weight gain.

Gut health plays a pivotal role in regulating appetite, metabolism, and fat storage, which directly impacts weight management. A balanced microbiome helps control hunger hormones like ghrelin and leptin, and supports optimal metabolic function, making it a critical factor in successful, sustainable weight loss.

Natural weight loss supplements, such as probiotics and prebiotics, offer long-term weight management without the side effects associated with pharmaceutical drugs like Ozempic and Mounjaro. These supplements support gut health, metabolic balance, and appetite regulation in a safer, more accessible manner, making them an attractive option for consumers seeking sustainable weight loss solutions.

The Indian weight loss market is expected to reach $55.9 billion by 2033, growing at a CAGR of 8.79%. This growth is driven by increasing demand for affordable, natural weight loss solutions, including nutraceuticals and functional foods aimed at gut health and metabolic wellness.